|

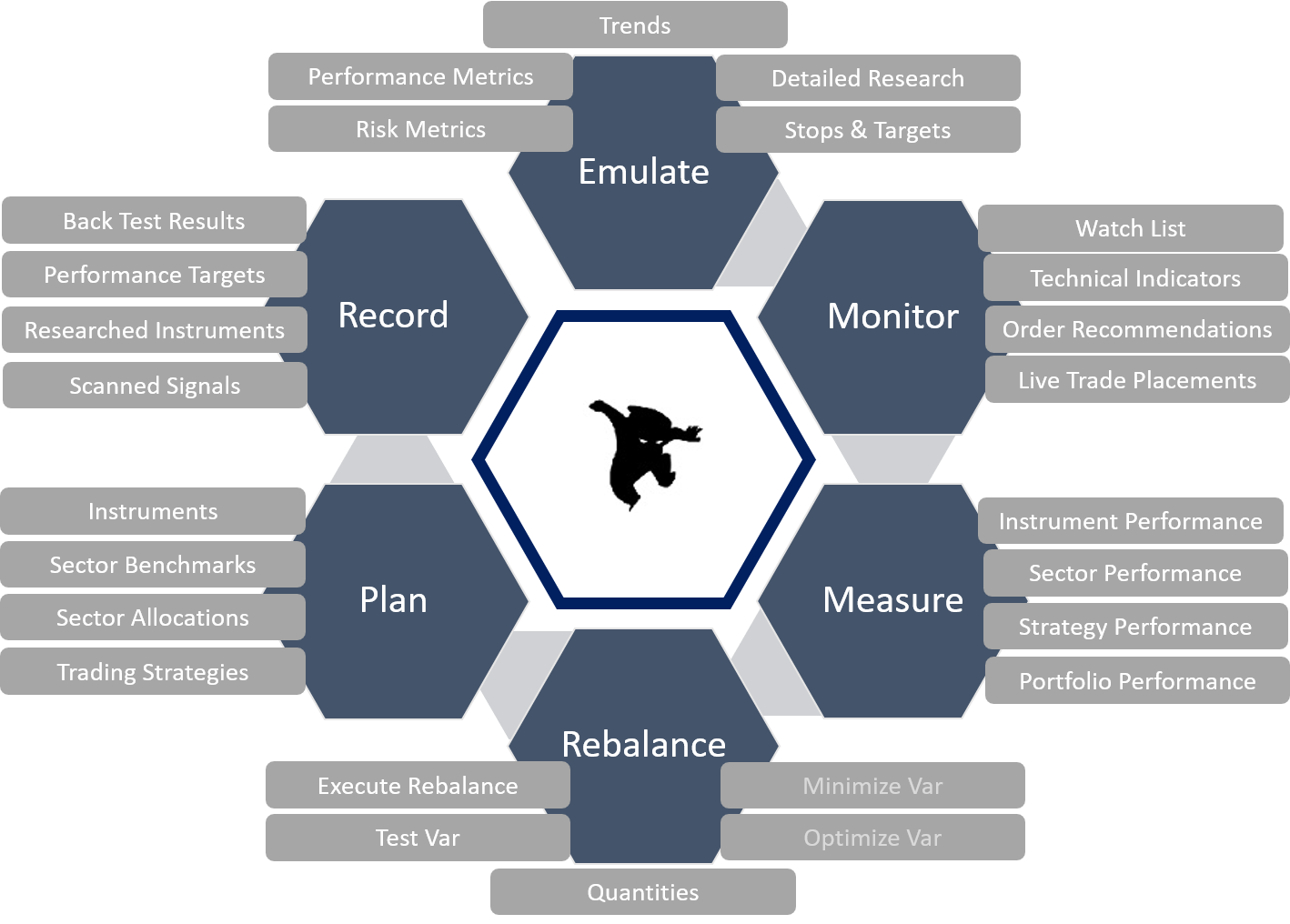

Tradelytics is a Not for Profit Platform that enables Investors, Wealth Managers and aspiring Analysts to emulate and execute Portfolio Management with the live market data for their simulated and live portfolios. Portfolio is measured for risk and reward. Users anywhere can record fundamental and technical analysis for all of their positions, monitor charts and re-balance the portfolio to earn stars for their effectiveness in maintaining their declared performance targets.

Check out User: demouser.tradelyticsninja@gmail.com Pwd: demo1234!

|

|

- All screens and charts can be accessed from Smart Phone, Tablet, Laptop and Desktops.

- Free 15 day trial, followed by fixed subscription fee of $25 / month to monitor a block of 300 Instruments at anytime. Additional blocks of 100 Instruments can be purchased at anytime. All the fees collected for membership is used for maintaining and expanding the infrastructure. Monthly billing and balances will be provided to all members.

- Dedicated Infrastructure can be provisioned at additional cost with full source code and associated documentation for tech-savy investors. Contact us at support@tradelyticsninja.com

- Basic recommendation engine allows users to specify trending , profit margin and allocation based buy and sell rules. Users can then compare the fundamental & technical indicators, performance, risk and predictions of their pipeline to place live trades.

- Users can choose either auto approval or their manual approval to place trades that have passed the recommendation rules.

- Platform exposes APIs . Any Trade Order Management System can integrate with the platform .

- AddOn for NinjaTrader is available to those who would wish to migrate from simulated portfolio to their live portfolio.

- Upon migration to live portfolio , all positions will flow into Tradelytics and all metrics will be calculated for live positions and live portfolio.

- After migration to live portfolio ,users can continue to drive live placements via their pipeline, perform and record detailed research, manage risk and hedge portfolio via their chosen algorithms.

|